How to fill the Wealth declaration form online; the ultimate guide and link:https://tsconline.tsc.go.ke/site/index

Section 26 and 27 of the Public Officer Ethics Act (POEA) requires all public officers to declare their Income, Assets and Liabilities (IAL). Since 2003 when the law requiring Public Officers to declare their Income, Assets and Liabilities (IAL) was enacted, the mode of declaration has been manual. Nowadays, the declaration is done online via portals provided to Public and Civil Servants in Kenya. All teachers are thus expected to fill an online Declaration by 31st December, 2019.

MODE OF DECLARATION

The Commission in 2017 Introduced an online Declaration Portal. This is the portal to be used for the 2017-2019 declarations. Declarations can be made following the steps outlined in the DIALS Manual.

The Declaration of Income, Assets and Liabilities form contains the following fields:

1. Name of the Public Officer; (Surname) (First name) (Other names)

2. Birth Information;

a. Date of birth

b. Place of birth

3. Marital Status

4. Address:

a. Postal address

b. Physical address

5. Employment Information:

a. Designation

b. Name of Employer

c. Nature of employment; (permanent, temporary, contract, etc)

d. T.S.C. No.

e. School/Institution

f. District

6. Name of spouse of spouses:

(i) (Surname) (First name) (Other names)

(ii) (Surname) (First name) (Other names)

iii) (Surname) (First name) (Other names)

(iv) (Surname) (First name) (Other names)

(v) (Surname) (First name) (Other names)

(vi) (Surname) (First name) (Other names)

(vii) (Surname) (First name) (Other names)

7. Name of dependent children under the ages of 18 years:

(i) (Surname) (First name) (Other names)

(ii) (Surname) (First name) (Other names)

(iii) (Surname) (First name) (Other names)

(iv) (Surname) (First name) (Other names)

(v) (Surname) (First name) (Other names)

(vi) (Surname) (First name) (Other names)

(vii) (Surname) (First name) (Other names)

(viii) (Surname) (First name) (Other names)

(ix) (Surname) (First name) (Other names)

8. Financial statement for________;

(A separate statement is required for the officer and each spouse and dependent child under the age of 18 years. Additional sheets should be added as required)

a. Statement date

(Statement date is the first day of the month preceding the month in which the declaration is due.)

b. Income, including emoluments, for the period from

_____________________________________to___________

(Including, but not limited to, salary and emoluments and income from investments, the period is from the previous statement date to the current statement date. For an initial declaration, the period is

the year ending on the statement date.)

c. Assets (as of the statement date)

(Including, but not limited to land, buildings, vehicles, investments and financial obligations owed to the person for whom the statement is made).

d. Liabilities (as of the statement date)

9. Other information that may be useful or relevant.

Declaration;

I solemnly declare that the information I have given in this declaration is, to the best of my knowledge, true and complete.

Signature of Officer: ________________________

Date: __________________

Witness:

Signature: _____________

Name: _________________

Address: ______________

Also read:

- Click here to Visit the TSC portal for all information related to teachers and TSC

- Education news portal: Click here to get all news from the Education Sector

- For information related to KNEC, KCSE, KCPE, P1 Exams; click here

- KUCCPS portal; Click to get all information on Colleges, university students and Polytechnics, TVETs

- Looking for news on the Higher Education Loans Board, HELB? Click here

- UNiversities and Colleges News Portal: Click here for all Courses, Admission Requirements, Portals, Fees, Contacts and Many More

- All Schools’ Portal: Complete guide to Primary and Secondary Schools

- All TSC services online portals and how to log in

- TSC TPAD data upload deadline

- Complete guide to the new TSC TPAD portal

- TSC: Full details on the newly established grades for teachers

- TSC: Designation codes for all teacher job groups

- TSC Grades and qualifications/ requirements for various administrative positions in schools

- TSC: Details on the current all 36 Teacher job groups/ grades

- TSC: Requirements, appointment and responsibilities of Principals

- All what you need to know and carry to a TSC teacher recruitment interview

- TSC: Requirements, responsibilities and appointment of Deputy Principals

STEP BY STEP GUIDE ON HOW TO FILL THE WEALTH DECLARATION FORM ONLINE

- Visit the TSC online portal at; https://tsconline.tsc.go.ke/site/index

- Enter your TSC Number and click on ‘NEXT’.

- On the next window, enter your Password and press on ‘LOGIN’. N/B; In case you have forgotten your password then click on ‘FORGOT PASSWORD’ to reset it.

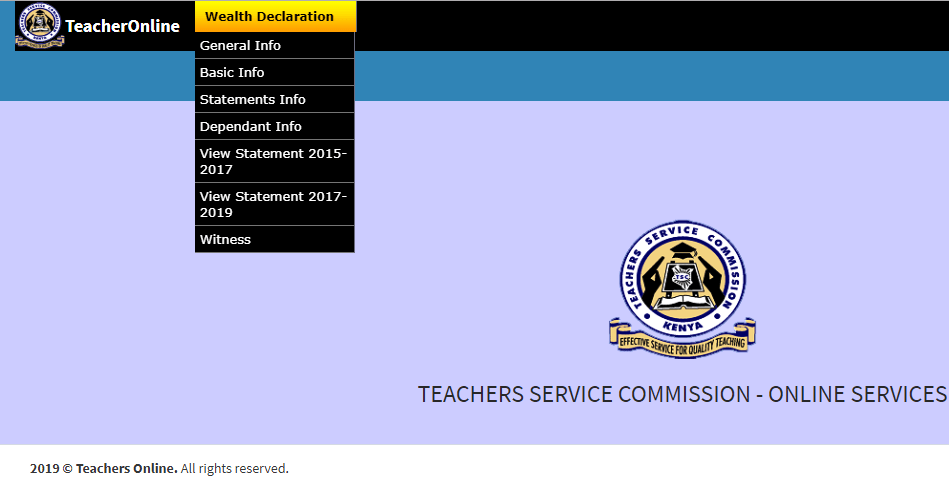

- Click on the ‘WEALTH DECLARATION’ tab and from the drop down list select ‘BASIC INFO’ to start off.

- Edit/ enter your data correctly and click on ‘NEXT’ when done; after entering your teaching subjects’ details.

- The next window is the ‘Personal Declaration’ window.

- Select ‘INCOME’ and this includes but not Limited to, Salary & Emoluments and Income from Investments. The period is from the previous statement date (2017) to the Current Statement Date (2019); a period of 24 months. For initial declaration, the period is the year ending on the Statement Date. Remember to click on the ‘ADD/ SAVE INCOME’ for each of the income after entering the Description and Approximate Amount. . Saved data will be displayed on the right side of your screen.

- Next is Assets. This includes, but not Limited to Land, Buildings, Vehicles, Investments and Financial Obligations owed to the person for whom the statement is made. Remember to click on the ‘ADD/ SAVE ASSETS’ for each of the income after entering the Description and Approximate Amount. . Saved data will be displayed on the right side of your screen.

- Click on Next to declare your liabilities which include, but not Limited to Financial Obligations owed by the person submitting the statement; Bank loans, SACCO Loans, HELB Loans e.t.c. Remember to click on the ‘ADD/ SAVE LIABILITIES’ for each of the income after entering the Description and Approximate Amount. . Saved data will be displayed on the right side of your screen.

- Select the ‘NEXT’ button so as to input dependants’ details; spouse(s) and children under the age of 18 Years, if any. Enter dependant’s details and remember to click on ‘ADD/SAVE’ after entering each dependant’s information. Saved data will be displayed on the right side of your screen. When done, strike the ‘NEXT’ button

- In the new window, enter any relevant information. If not available click on the ‘NEXT’ button to by-pass this step.

- Witness; This is the final step. Enter the details of your Witness (Someone who knows you; it can be your relative or work mate).

- You can preview your entries by clicking on ‘VIEW SUMMARY’ and make amendments where and when necessary. If satisfied with your entries, then press on ‘SUBMIT’. A copy of the declaration will be sent to your Email address.