New York Retirement News

News from the New York State and Local Retirement System

Tier 3 & 4 Members: When Is The Right Time To Retire?

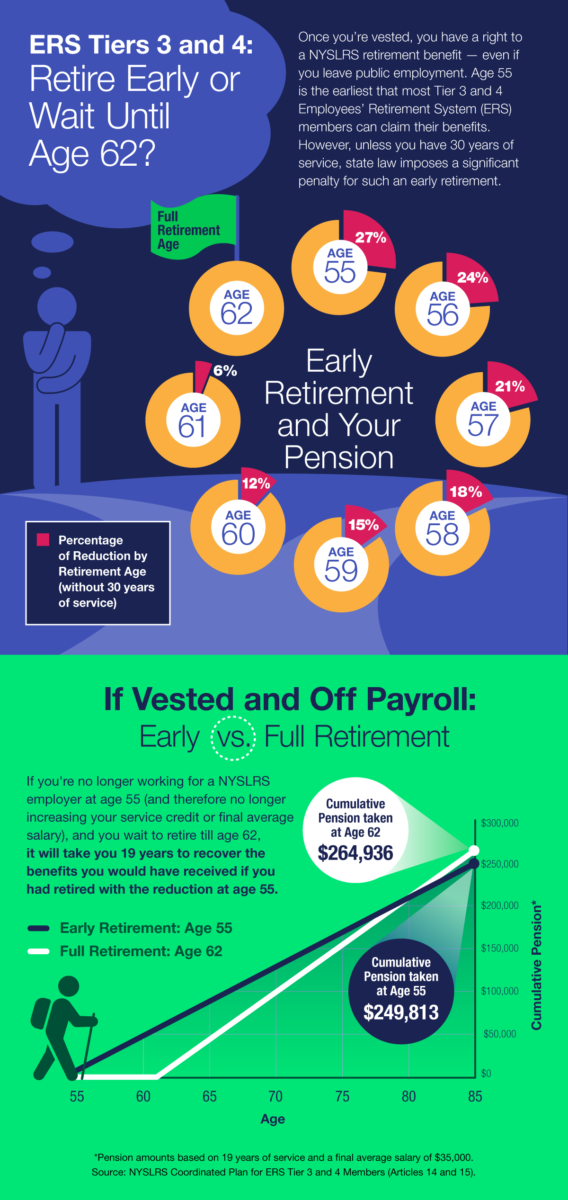

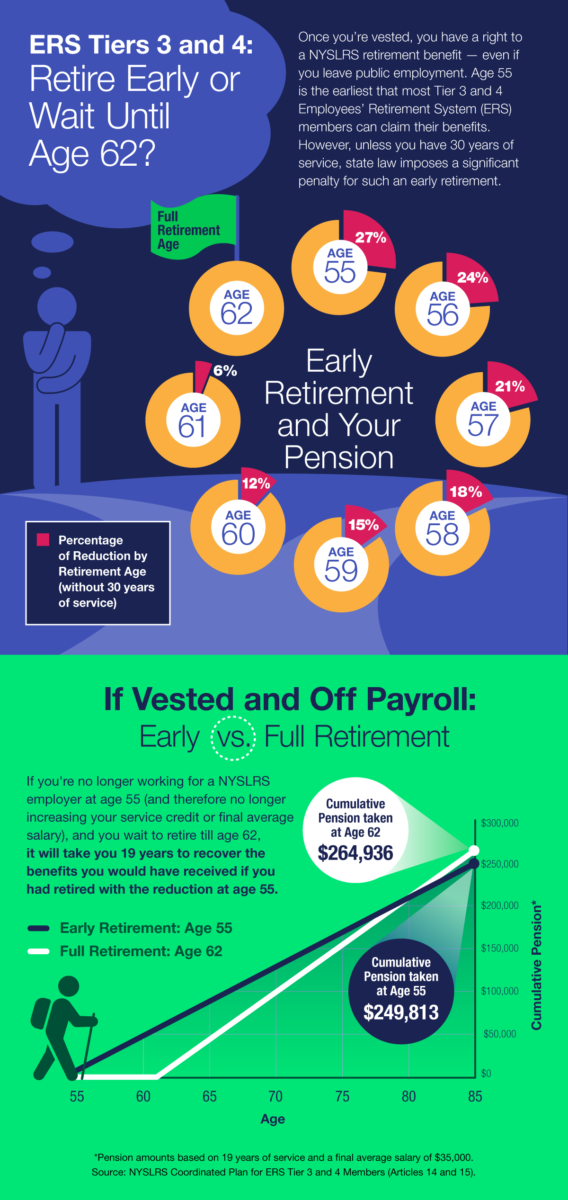

Tier 3 and 4 members in the Article 15 retirement plan qualify for retirement benefits after they’ve earned five years of credited service. Once you’re vested, you have a right to a NYSLRS retirement benefit — even if you leave public employment. Though your pension is guaranteed, the amount of your pension depends on several factors, including when you retire. Here is some information that can help you determine the right time to retire.

Three Reasons to Keep Working

- Tier 3 and 4 members can claim their benefits as early as age 55, but they’ll face a significant penalty for early retirement – up to a 27 percent reduction in their pension. Early retirement reductions are prorated by month, so the penalty is reduced as you get closer to full retirement age. At 62, you can retire with full benefits. (Tier 3 and 4 Employees’ Retirement System (ERS) members who are in the Article 15 retirement plan and can retire between the ages of 55 and 62 without penalty once they have 30 years of service credit.)

- Your final average earnings (FAE) are a significant factor in the calculation of your pension benefit. Since working longer usually means a higher FAE, continued public employment can increase your pension.

- The other part of your retirement calculation is your service credit. More service credit can earn you a larger pension benefit, and, after 20 years, it also gets you a better pension formula. For Tier 3 and 4 members, if you retire with less than 20 years of service, the formula is FAE × 1.66% × years of service. Between 20 and 30 years, the formula becomes FAE × 2.00% × years of service. After 30 years of service, your pension benefit continues to increase at a rate of 1.5 percent of FAE for each year of service.

If You’re Not Working, Here’s Something to Consider

Everyone’s situation is unique. For example, if you’re vested and no longer work for a public employer, and you don’t think you will again, taking your pension at 55 might make sense. When you do the math, full benefits at age 62 will take 19 years to match the money you’d have received retiring at age 55 — even with the reduction.

An Online Tool to Help You Make Your Decision

Most members can use Retirement Online to estimate their pensions.

A Retirement Online estimate is based on the most up-to-date information we have on file for you. You can enter different retirement dates to see how those choices would affect your benefit, which could help you determine the right time to retire. When you’re done, you can print your pension estimate or save it for future reference.

If you are unable to use our online pension calculator, please contact us to request a pension estimate.

This post has focused on Tier 3 and 4 members. To see how retirement age affects members in other tiers, visit our About Benefit Reductions page.

Share this post:

Content last revised June 2, 2021.

187 thoughts on “ Tier 3 & 4 Members: When Is The Right Time To Retire? ”

- Daniel AndersonJune 22, 2024 at 10:49 am another question. they told me the price to buy back my tier. I agreed to have it taken out of my pay then I got a letter saying that the employer was told to not deduct anymore from my ck and I got a refund in my pay the next pay of the amount they took in previous ck. so the Question what happened to the agreed price I was supposed to pay, also I knew I was vested tier 4 before I left state services so does this letter mean I have finished my payments or do I need to call NYSLRS to find out?

- NYSLRS Post author June 24, 2024 at 12:47 pm For account-specific questions, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRS Post author May 22, 2024 at 10:52 am NYSLRS members can only earn one year of service credit per calendar year. However, when you retire, all or part of your overtime pay may be included in the calculation of your final average earnings (FAE). For most members, FAE is the average of the member’s three highest consecutive years of earnings, but there are limits specific to their tier and plan. Find your retirement plan publication for specific information about your benefits. You can find your estimated total service credit and create a pension estimate based on information we have on file for you in Retirement Online. For account-specific information, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

- JRMay 27, 2024 at 10:39 pm Hello. If I have 20 years of total serice making $30k per year (NYCTRS tier 4 part time adjunct lecturer) and then get a full time position as an administrator for the last 5 years (years 20-25) making $100k per year, it would be calculated as 25 years of total service with a FAS of $100k correct? Am I missing anything that I should be aware of? Thank you.

- NYSLRS Post author May 29, 2024 at 8:14 am For ERS Tier 4 members, their pension is based on the average of their three highest consecutive years of earnings. If the earnings in any 12-month period in their FAS exceeds the average of the previous two years by more than 10 percent, the amount above 10 percent will not be included in the FAS calculation. For specific information about your situation, you can message our customer service representatives using our secure contact form.

- NYSLRS Post author May 20, 2024 at 1:30 pm For most members, you will receive your first pension payment at the end of the month following your retirement month. The quickest way to get your pension payment is by using direct deposit so you’ll receive your pension payment on the last business day of each month. Paper checks take longer to receive and are mailed on the second-to-last business day of the month. If you have account-specific questions about your pension benefits, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSMay 16, 2024 at 1:53 pm Generally, if you are a Tier 3-6 ERS member in a regular retirement plan, there is no maximum benefit. For more information, please check your retirement plan publication. Most members can use the benefit calculator in Retirement Online to estimate their pensions based on information we have on file for them. If you have account-specific questions, please call our customer service representatives at 866-805-0990, press 2, then follow the prompts.

- NYSLRS Post author May 14, 2024 at 2:59 pmPension reductions for early retirement depend on your age, tier and retirement system. Most members can create a pension estimate in Retirement Online based on information we have on file for them. You can enter different retirement dates to see how those choices would affect your benefit. If you have account-specific questions about your situation, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRS Post author February 27, 2024 at 2:13 pm Yes, payment for unused vacation time would be included in calculating the 10 percent limit for Tier 4 members. For account-specific information about how this may apply in your situation, you can message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRS Post author December 20, 2023 at 1:00 pm We recommend that you message our customer service representative using our secure contact form for information specific to your situation. Filling out the secure form allows them to safely contact you about your personal account information.

- NoneJanuary 7, 2024 at 10:21 pm It would have been helpful to answer this for everyone even if it was a generic answer

- NYSLRS Post author January 8, 2024 at 12:49 pm The rules and restrictions for working after retirement depend on: • The type of retirement benefit you are receiving (service or disability);

• The employer you will be working for (private, public, yourself, etc.);

• Your date of membership and tier; and

• Your age. You can find general information in our publication, Life Changes: What If I Work After Retirement? If you have questions about your particular situation, we recommend you message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSNovember 3, 2023 at 12:56 pm Most NYSLRS members can quickly create pension estimates using Retirement Online. Your estimate will be based on the most up-to-date account information we have on file for you. You can enter different retirement dates to see how those choices would affect your benefit and adjust your earnings or service credit if you anticipate a raise or plan to purchase past service. For account-specific questions about your retirement date, we recommend that you contact our customer service representatives using the secure contact form on our website (http://www.emailNYSLRS.com). Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRS Post author July 13, 2023 at 1:43 pm For questions about your retirement status, please call our customer service representatives at 866-805-0990, press 2, then follow the prompts. You can also message them using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRS Post author June 30, 2023 at 1:39 pm Being vested means that you have earned enough service credit to qualify for a pension benefit once you meet the minimum age requirements established by your retirement plan. Members who have at least five years of credited service are vested. For more information about vesting, visit our Are You Vested? And What It Means page.

- NYSLRSJune 7, 2023 at 12:30 pm For account-specific questions about your pension payments, please call our customer service representatives at 866-805-0990, press 2, then follow the prompts. You can also message them using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSMay 11, 2023 at 12:42 pm This blog is for members and retirees of the New York State and Local Retirement System (NYSLRS), the retirement system for employees of New York State and municipalities outside of New York City. If you are a member of NYSLRS, please message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information. If you are a member of the New York State Teachers’ Retirement System (NYSTRS), you can contact their customer service representatives at https://www.nystrs.org/contact for assistance.

- NYSLRS Post author April 5, 2023 at 1:03 pm That depends on your tier and retirement plan. In most cases, Tier 2, 3 and 4 ERS members who are age 55 or older and have 30 or more years of service credit can retire with their full benefit. You can find out more about penalties for early retirement on our website For account-specific information, you can message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

- Tom DJune 26, 2023 at 4:20 pm why do you keep saying 2,3,4 tiers get thier full retirement w 55 and 30 years as stateed above, its 62 years of age according to your statements is full benefits amount you can collect.

- NYSLRS Post author June 27, 2023 at 2:50 pm Depending on their retirement plan, most Employees’ Retirement System members in Tiers 2, 3, 4 (and some who are in Tier 5) who have 30 or more years of service can retire as early as age 55 with no reduction for early retirement. For details, visit our About Benefit Reductions page. If you have questions about your specific situation, please call our customer service representatives at 866-805-0990, press 2, then follow the prompts. You can also message them using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSMarch 21, 2023 at 2:59 pm Members who joined the Employees’ Retirement System (ERS) from September 1, 1983 through December 31, 2009 are in Tier 4, though New York State correction officers who joined ERS from July 27, 1976 through December 31, 2009 are in Tier 3. To look up your tier, sign in to your Retirement Online account and look under ‘My Account Summary.’ For more tier information, please visit our What Tier Are You In? page.

- NYSLRS Post author January 30, 2023 at 12:23 pm Most Tier 5 members can retire at age 55, but they will face a pension benefit reduction if the retire before 62. You can sign in to Retirement Online to estimate your pension benefit based on the information we have on file for you. For general information about your retirement benefits, please check your retirement plan publication. For account-specific information, please contact our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRS Post author January 30, 2023 at 12:21 pm Yes, we have information for Tier 5 members, including our recent blog post about Tier 5 milestones for Employees’ Retirement System members.

- NYSLRSAugust 29, 2022 at 2:32 pm For specific questions about your NYSLRS retirement plan, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSSeptember 30, 2022 at 3:39 pm If you are in the Article 15 retirement plan, you can read Tier 4 retirement benefit calculation information our website. For specific questions about your NYSLRS retirement plan, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- Nancy CarpenterOctober 4, 2022 at 1:00 pm Here is the information on the ss adjustment and who it impacts. Your Social Security retirement or

disability benefits can be reduced

The Windfall Elimination Provision can affect how we

calculate your retirement or disability benefit. If you work

for an employer who doesn’t withhold Social Security

taxes from your salary, any retirement or disability

pension you get from that work can reduce your

Social Security benefits. Such an employer may be a

government agency or an employer in another country.

When your benefits can be affected

This provision can affect you if both the following

are true:

• You earn a retirement or disability pension from an

employer who didn’t withhold Social Security taxes.

• You qualify for Social Security retirement or disability

benefits from work in other jobs for which you did

pay taxes.

The Windfall Elimination Provision can apply if one of

the following is true:

• You reached age 62 after 1985.

• You developed a qualifying disability after 1985.

If the latter applies, you must first have become eligible

for a monthly pension based on work where you didn’t

pay Social Security taxes after 1985. This rule applies

even if you’re still working.

This provision also affects Social Security benefits

for people who performed federal service under the

Civil Service Retirement System (CSRS) after 1956.

We won’t reduce your Social Security benefit amount

if you only performed federal service under a system

such as the Federal Employees’ Retirement System

(FERS). Social Security taxes are withheld for workers

under FERS.

How it works

Social Security benefits are intended to replace only

some of a worker’s pre-retirement earnings.

We base your Social Security benefit on your average

monthly earnings adjusted for average wage growth.

We separate your average earnings into three amounts

and multiply the amounts using three factors to compute

your full Primary Insurance Amount (PIA). For example,

for a worker who turns 62 in 2022, the first $1,024

of average monthly earnings is multiplied by 90%;

earnings between $1,024 and $6,172 are multiplied by

32%; and the balance by 15%. The sum of the three

amounts equals the PIA, which is then decreased or

increased depending on whether the worker starts

benefits before or after full retirement age (FRA). This

formula produces the monthly payment amount.

When we apply this formula, the percentage of career

average earnings paid to lower-paid workers is greater

than higher-paid workers. For example, workers age

62 in 2022, with average earnings of $3,000 per month

could receive a benefit at FRA of $1,553 (approximately

51%) of their pre-retirement earnings increased by

applicable cost of living adjustments (COLAs). For a

worker with average earnings of $8,000 per month, the

benefit starting at FRA could be $2,843 (approximately

35%) plus COLAs. However, if either of these workers

start benefits earlier than their FRA, we’ll reduce their

monthly benefit.

Why we use a different formula

Before 1983, people whose primary job wasn’t

covered by Social Security had their Social Security

benefits calculated as if they were long-term, low-wage

workers. They had the advantage of receiving a Social

Security benefit representing a higher percentage of

their earnings. Also they had a pension from a job for

which they didn’t pay Social Security taxes. Congress

passed the Windfall Elimination Provision to remove

that advantage.

Under the provision, we reduce the 90% factor in our

formula and phase it in for workers who reached age 62

or developed a disability between 1986 and 1989. For

people who reach 62 or developed a disability in 1990

or later, we reduce the 90% factor to as little as 40%.

Some exceptions

The Windfall Elimination Provision doesn’t apply if:

• You’re a federal worker first hired after

December 31, 1983.

• You’re an employee of a non-profit organization

who was exempt from Social Security coverage

on December 31,1983. This does not apply if the

non-profit organization waived exemption and did

pay Social Security taxes, but then the waiver was

terminated prior to December 31, 1983.

• Your only pension is for railroad employment.

- NYSLRSOctober 4, 2022 at 12:54 pm A customer service representative can explain your NYSLRS retirement benefits to you and provide an estimate of your pension amount. You can call them at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email them using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information. For information about your Social Security benefits, please contact the Social Security Administration.

- Rosemary SpanoOctober 4, 2022 at 1:31 pm It is almost impossible to contact Social Security. I would have to take a day off work.

- NYSLRS Post author July 25, 2022 at 12:21 pm Most Tier 6 members with 30 years of service credit would receive 55 percent of their Final Average Earnings (FAE) if they retire at full retirement age. For information about how Tier 6 benefits are calculated, please see your retirement plan booklet on our Publications page. For questions about how this may apply in your situation, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information. Retirement benefits are established by law. The decision on whether to enact new laws comes from the State Legislature and the Governor. The State Legislature would need to pass a bill and the Governor would need to sign it into law in order to change contribution requirements.

- Dale LarsenFebruary 19, 2023 at 9:25 pm When the Legislature created Tier 4 a state employee received 3.5 hrs. sick and 3.5 hrs. vacation. The Legislature changed Tier 4. The Legislature also changed Tier 3 and gave these employees the Tier 4 / Article 15 Option. The Legislature also eliminated the 3% contribution after 10 years of service. Tier 6 is significantly different than the other Tiers. It was created by our former Governor Andrew Cuomo. I personally hope our Tier 6 employees lobby the Legislature to modify the language and reduce the ability to retire from 63 back down to 55 years of age. Tier 6 has flaws. The State is demanding that even teachers must work an additional 8 years. We will see how this works as employees in the future enter into their later years in life and realize they are burnt out and have health issues but still are not close to retirement. The next generation will be observing a system of older state employees and a system that isn’t creating job opportunities. No one will remember the man and the elected officials who purposefully and significantly raised the retirement age. I would assume that the State is already having some issues with recruiting younger people. Gov. Cuomo and his influential acquaintances of the “Committee to Save NY” played the game well. Once they received the TARP funds they disbanded and left New York State in a worse mess.

- NYSLRSFebruary 21, 2023 at 12:30 pm A point of clarification: Tier 6 members in the Article 15 retirement plan can retire as early as age 55. Benefits would be reduced, however, if they retire before age 63.

- NYSLRS Post author July 18, 2022 at 1:50 pm For information about the status of your account and your options, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRS Post author July 7, 2022 at 12:29 pm Members in the Article 15 retirement plan who leave public employment can begin receiving their full pension when they reach full retirement age, which is 62 or 63, depending on their tier. You can find out more about penalties for early retirement on our website.

- NYSLRS Post author April 5, 2023 at 1:03 pm In most cases, Tier 2, 3 and 4 ERS members who are age 55 or older and have 30 or more years of service credit can retire with their full benefit. For account-specific information, you can message our customer service representatives using our secure contact form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSJune 30, 2022 at 1:48 pm Most retirement plans do not have a mandatory retirement age, but if you have left public employment, there may be no advantage in delaying collection of your pension after you reach full retirement age (62 or 63, depending on your tier). For account-specific information about how this may apply in your situation, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSMarch 15, 2022 at 12:24 pm For details about your retirement benefit calculation, please read your retirement plan booklet on our Publications page or email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSMarch 8, 2022 at 12:35 pm We’re sorry for the trouble you’re having. Your message is important to us and we have sent you a private message in response.

- NYSLRSJuly 26, 2022 at 5:53 pm Your message is important to us, and we have sent you a private message in response.

- NYSLRS Post author January 24, 2022 at 12:07 pm The NYSLRS social media team does not have access to your account information, but we’d like to help. For assistance, please call our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email them using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRS Post author January 7, 2022 at 1:41 pm We apologize for trouble you are having. Your message is important to us and we have sent you a private message in response.

- NYSLRS Post author January 18, 2022 at 12:05 pm We apologize for the delay. Your message is important to us and we have sent you a private message in response.

- GSMay 18, 2022 at 11:15 am Hi, i have the same issue. I applied for Tier 4 reinstatement back in July 2019 and have not heard a thing. I call and get hung up on saying high call volume. I tried emailing and got a canned response. I didn’t think it took 3 years to find this out. Is there any way I can get an answer?

- NYSLRSMay 18, 2022 at 12:22 pm Your message is important to us and we have sent you a private message in response.

- NYSLRS Post author January 5, 2022 at 2:20 pm If you work part-time, your service credit is prorated. For more information about how part-time service credit is calculated, please read our blog post How Full-Time and Part-Time Service Credit Works. If you work for a school district, please read the blog post How School Employees Earn NYSLRS Service Credit. For information about how this may apply in your particular situation, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSNovember 9, 2021 at 2:23 pm Final average earnings (FAE) is the average of a member’s three (five for Tier 6) highest consecutive years of earnings, subject to limitations. Those limitations vary by tier and retirement plan. You can find more information on our Final Average Earnings page. For account-specific questions, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSOctober 8, 2021 at 12:51 pm Thank you for your input.

- NYSLRS Post author January 7, 2022 at 1:39 pm Thank you for your input.

- NYSLRSOctober 5, 2021 at 3:26 pm Your tier is based on your date of membership. Purchasing credit for previous service will not change your tier if you didn’t join a public retirement system while working for that employer. For account-specific information, you can email our customer service representatives using the secure email form on our website (http://www.emailNYSLRS.com). One of them will review your account and respond to your questions. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSOctober 5, 2021 at 3:25 pm Your message is important to us and we have sent you a private message in response.

- NYSLRS Post author July 15, 2021 at 3:06 pm The penalty for early retirement only becomes effective when you start collecting your pension. For example, if you leave public employment at age 59 but don’t apply to receive benefits until you turn 60, the age 60 reduction would apply. However, leaving public payroll before you are eligible to retire may affect your eligibility for certain death benefits and health benefits. If you are considering leaving the public payroll before you are ready to retire, we suggest you speak with a customer service representative to find out how it would affect your pension benefits. You can call them at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email our them using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information. You may also wish to speak to your health benefits administrator to find out how going off payroll would affect any post-retirement health benefits you may be entitled to.

- Robert BushOctober 4, 2021 at 4:30 pm Can someone give an example of their monthly take-home pension? How much for a tier 4 with 30 years at age 59?

- NYSLRSOctober 5, 2021 at 3:28 pm Most members can use the benefit calculator in Retirement Online to estimate their pensions based on information we have on file for them. Sign in to your account, go to the My Account Summary area of your Account Homepage and click the “Estimate my Pension Benefit” button. If you need help with Retirement Online, please contact the NYSLRS Call Center at 1-866-805-0990 (or 518-474-7736 in the Albany, New York area). Press 2 and follow the prompts. The Call Center is available Monday through Friday from 7:30 am – 5:00 pm.

- NYSLRS Post author July 2, 2021 at 2:13 pm To find out how the FAS would be calculated in your specific circumstances, please call our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email them using our secure email form. Filling out the secure form allows our representatives to safely contact you about your personal account information.

- NYSLRS Post author June 9, 2021 at 12:32 pm This information applies to members of the New York State and Local Retirement System (NYSLRS) who are in Tiers 3 and 4 and covered under the Article 15 retirement plan. If you are in another NYSLRS retirement plan, you can find information about your benefits in your retirement plan booklet or by contacting our customer service representatives using our secure email form. If you are a member of another retirement system, please contact them.

- NYSLRS Post author April 16, 2021 at 1:04 pm Yes, Tier 3 and 4 Employees’ Retirement System members who are in the Article 15 retirement plan and have 30 years of service credit can retire at age 55 without penalty. For account-specific information, please email our customer service representatives using the secure email form on our website (http://www.emailNYSLRS.com). One of them will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

- NYSLRS Post author June 3, 2021 at 12:43 pm If you chose to leave public employment, you would be able to apply for a vested retirement benefit as early as age 55. However, leaving public payroll before you are eligible to retire may affect your eligibility for certain death benefits and health benefits. If you are considering leaving public payroll before age 55, we suggest you email our customer service representatives using the secure email form on our website to ask how it would affect your pension benefits. A representative will contact you to address your questions. Filling out the secure form allows them to safely contact you about your personal account information. You may also wish to speak to your health benefits administrator to find out how going off payroll would affect any post-retirement health benefits you may be entitled to.

- TOM HUNTSAugust 5, 2022 at 10:56 am your so correct Maam- staying the extra year or two for 250 more a month is not worth it at all, like you said no union dues no worrying about getting holidays off after 33 years, fighting to get mothers or fathers day off because the 20 somethings cant bother to come to work. I’m so done with this.

- NYSLRSAugust 17, 2021 at 3:08 pm Tier 3 and 4 Employees’ Retirement System members who are in the Article 15 retirement plan and have 30 years of service credit can retire at age 55 without penalty.

- NYSLRS Post author April 14, 2021 at 3:28 pm Most Tier 4 members can retire as early as age 55, however, those who retire before age 62 with less than 30 years of service credit may face a permanent benefit reduction. You can find information about benefit reductions for early retirement on our website. Most Tier 2 – 6 members can use Retirement Online to create a NYSLRS pension estimate based on the salary and service information we have on file for you. You can enter different retirement dates to see how your choices affect your potential benefit. For account-specific information, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRS Post author April 14, 2021 at 3:27 pm If you leave public service before full retirement age (62 or 63, depending on your tier), you can apply for and receive a pension without penalty when you reach retirement age. However, leaving public payroll before retiring may affect your eligibility for certain death benefits and health benefits. We suggest you email our customer service representatives using the secure email form on our website to ask how it would affect your pension benefits. Filling out the secure form allows them to safely contact you about your personal account information. You may also wish to speak to your health benefits administrator to find out how going off payroll would affect any post-retirement health benefits you may be entitled to.

- NYSLRS Post author March 22, 2021 at 1:53 pm Members in regular retirement plans must be at least 55 years old to begin receiving a NYSLRS service retirement benefit. For account-specific information, please email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRS Post author February 9, 2021 at 1:19 pm Most members in regular retirement plans who retire at age 55 will face a pension reduction for early retirement. The reduction percentage depends on your retirement plan and tier. There is no additional reduction for leaving public employment before age 55. For information about your specific circumstances, please call our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area), press 2, then follow the prompts. You can also email our customer service representatives using our secure email form. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRS Post author February 3, 2021 at 1:21 pm Yes, your final average salary will be calculated on the three consecutive years when your earnings were highest, regardless of when they happen in your career.

- NYSLRS Post author July 27, 2020 at 12:54 pm As a Tier 4 member, unless you are in a special plan that allows retirement after 20 or 25 years regardless of age, you must be at least 55 years old to retire and collect a NYSLRS service retirement benefit. If you are permanently disabled and cannot perform your duties because of a physical or mental condition, you may be eligible for a disability retirement benefit. For account-specific questions, please email our customer service representatives using the secure email form on our website (http://www.emailNYSLRS.com). One of them will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

- NYSLRS Post author May 12, 2020 at 2:51 pm If you are a vested member of a regular retirement plan, and you leave public employment before age 55, you can begin collecting your pension once you turn 55. You should be aware that if you leave public employment before you are old enough to receive a pension, you may lose certain retiree benefits, such as death benefits. You should contact our customer service representatives at 1-866-805-0990 (or 518-474-7736 in the Albany, NY area) for more information. You should also speak to your health benefits administrator to find out how health benefits would be affected. Please note: Your pension is not automatic; you must apply for retirement to receive a benefit. You can file for retirement using Retirement Online. For more information, please read our booklet What if I Leave Public Employment?

- NYSLRSMay 6, 2020 at 5:12 pm A Tier 4 member with 30 years of service credit can receive a NYSLRS retirement benefits at 55 without penalty, even if they left public employment before they were eligible to retire. However, leaving public service before retirement may affect other benefits. You may wish to read our booklet What if I Leave Public Employment? for more information, and email us using the secure form on our website if you have questions. You may also wish to speak to your health benefits administrator to find out how leaving employment before retirement might affect your health benefits.

- NYSLRS Post author February 10, 2020 at 3:07 pm With ten years of service, you’ll be eligible for a NYSLRS pension even if you leave public service before retirement age. However, most NYSLRS members must be at least 55 years old to begin receiving a pension. For account-specific information, please email our customer service representatives using the secure form on our website (http://www.emailNYSLRS.com). One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

- NYSLRS Post author February 5, 2020 at 2:24 pm Your question and circumstances would be better addressed by the Social Security Administration. You can call them at 1-800-772-1213.

- Roe SpanoApril 14, 2021 at 4:07 pm Social Security will not budge on this, Just want to let other school employees know what they are facing when they retire. There are parameters that must be met and many school employees do not meet them. So check before you retire.

- NYSLRS Post author January 23, 2020 at 1:44 pm A Tier 3 or 4 member who retires at age 62 with 23 years of service credit will receive 2 percent of their final average salary for each year of service (for a total of 46 percent of FAS). “Full benefits” means there would be no penalty for early retirement. Most members can use the pension benefit calculator on our website to estimate your pension based on information you enter. You can enter different retirement dates, final average salaries and service credit totals to compare different outcomes.

- David JohnsonJune 7, 2021 at 11:20 am I’m in a 25 year plan. Would there be an advantage to retiring with 21 years service at 60 years of age?

- NYSLRS Post author June 8, 2021 at 2:37 pm Most members can use the calculator in Retirement Online to estimate their NYSLRS pension based on the salary and service information we have on file for them. You can enter different retirement dates, final average earnings and service credit totals to compare retirement outcomes. For account-specific information questions, please email our customer service representatives using our secure email form. One of our account representatives will be able to answer your questions. Filling out the secure form allows them to safely contact you about your personal account information.

- NYSLRSNovember 26, 2019 at 4:25 pm Final Average Salary (FAS) is the average of the highest three (five for Tier 6) consecutive years of earnings. The years used in calculating your FAS are usually your last three years of employment, and they do not need to correspond to the calendar year, the State fiscal year or hiring date.

- Nancy CarpenterJune 3, 2021 at 3:09 pm For clarification Lorna Moffre, it is your 36 highest consecutive months.

- NYSLRS Post author November 19, 2019 at 1:57 pm You can find out how unused, unpaid sick leave may affect your pension calculation by reading our blog post titled What Unused Sick Leave Might Mean For You at Retirement. Once you know approximately how much service your sick leave would provide, you can use our online calculator to estimate your pension with and without the additional service. For account-specific information, please email our customer service representatives using the secure form on our website (http://www.emailNYSLRS.com). One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

- NYSLRS Post author September 6, 2019 at 2:54 pm If you are in a retirement plan that allows for retirement with no reduction at age 62, there’s no waiting period after you turn 62. We recommend that you contact our customer service representatives to ask any account-specific questions you may have before you choose a date. You can email them using the secure email form on our website (http://www.emailNYSLRS.com). You may also find our publication, How Do I Prepare to Retire, helpful. It’s available at http://www.osc.state.ny.us/retire/publications/vo1709.php.

- NYSLRS Post author July 1, 2019 at 2:28 pm You are correct, for most members, age is a factor in retirement benefit calculations.

If you are a Tier 4 member with less than 30 years of service, and you retire (collect your pension) before age 62, your pension will be permanently reduced. Whether you collect your pension immediately upon leaving public service is up to you. You can delay taking your pension and continue working till you turn 62 and receive a full benefit. Tier 4 members can use our Benefit Projector Calculator to estimate what your benefit would be at different retirement dates. You may also be interested in our publication What If I Leave Public Employment?

- NYSLRS Post author June 18, 2019 at 3:14 pm Most NYSLRS members must be at least 55 to collect a pension. If you are considering leaving payroll before you retire, you should contact our customer service representatives to discuss how that would affect your NYSLRS benefits. We would also recommend that you speak to your health benefits administrator to find out how any post-retirement health benefits would be affected. For account-specific information, please email our customer service representatives using the secure form on our website (http://www.emailNYSLRS.com). One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information. You may also wish to read our publication What If I Leave Public Employment?

- NYSLRS Post author February 25, 2019 at 12:06 pm You cannot submit an application for retirement benefits more than 90 days before your retirement date.

If you are considering going off the payroll and waiting to collect your pension, you should speak to a customer service representative about how that would affect your benefits. For example, depending on your retirement plan, you may need to retire (collect your pension) within a certain amount of time after leaving the payroll to maintain eligibility for certain death benefits.

You can email our customer service representatives using our secure email form (http://www.emailNYSLRS.com), and one of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

You may also want to speak to your employer health benefits administrator to find out how leaving payroll and waiting to collect your pension would affect your health benefits.

- NYSLRS Post author February 7, 2019 at 7:36 am Assuming you are in the regular ERS Article 15 retirement plan, for each year of service beyond 30 years, you’ll receive 1.5 percent of your final average salary (FAS) with no maximum percentage. For the first 30 years, you’d receive 60 percent of your FAS. You can find information about your pension benefit in your plan publication. For information about your specific situation, please email our customer service representatives using our secure email form. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

- NYSLRS Post author November 14, 2018 at 2:58 pm Under most Tier 4 retirement plans, you must be 62 years old (or have 30 years of service credit) to retire with your full benefit. However, you may retire as early as age 55 with a reduction for early retirement. The specific amount of the reduction varies by age. For information about your particular situation, please email our customer service representatives using our secure email form. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

- NYSLRS Post author July 31, 2018 at 7:47 am Certain retirement plans may have a mandatory retirement age, but unfortunately, the NYSLRS Social Media Team does not have access to your account information to determine if they apply to you. To get the account specific information you need, we recommend emailing our customer service representatives using our secure email form. One of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

- NYSLRS Post author May 4, 2018 at 3:44 pm Generally, unless you retire under a disability retirement, earnings are unlimited for retirees if they are self-employed; work for a private employer; work for another state or its political subdivisions; or work for the federal government. For more information, we suggest reading our Life Changes: What If I Work After Retirement? publication.

- NYSLRS Post author May 4, 2018 at 3:40 pm You are correct that Tier 4 members in the Employees Retirement System with 30 years of service credit can retire at age 55 without a benefit reduction. And, yes; with 30 years of service, your calculation would be 60 percent of your FAS. However, members retiring before age 62 without 30 years of service credit would see a significant reduction in their benefits as shown in the graphic.

- NYSLRS Post author May 4, 2018 at 8:18 am If you are an ERS member in Tier 3 or 4 and over age 55, you will be eligible for your full retirement benefit once you reach 30 years of service. Which day you retire is up to you, but if you are thinking of retiring this year, you may want to contact our Customer Service Representatives to request a benefit projection or discuss your options. To get the account-specific information you need, please email our customer service representatives using our secure email form (http://www.emailNYSLRS.com), and one of our representatives will review your account and respond to your questions. Filling out the secure form allows us to safely contact you about your personal account information.

- NYSLRS Post author May 4, 2018 at 8:22 am You are right. When you reach 20 years of service, the first 20 years of service are calculated at 2 percent instead of 1.66 percent. We apologize for the confusion, and we have updated the blog to make that clear. Thank you.

- NYSLRS Post author May 4, 2018 at 8:18 am At this time, we’re not aware of any discussions about statewide retirement incentives. The New York State Legislature (not NYSLRS) occasionally enacts these retirement incentive programs, which are approved by both houses and signed into law by the Governor. The Retirement System administers programs that are signed into law. We’ll notify your employer if the Legislature makes a State incentive program available. Non-State employers (such as Counties) may choose to offer incentives to their employees, however, it’s important to note that these individual employer incentives will not affect a member’s NYSLRS pension benefits.

- NYSLRS Post author May 4, 2018 at 8:21 am That depends on your situation. If you are a Tier 3 or 4 member with 30 years of service, you can retire at 55 with no reduction to your benefits. But if you continue to work till 62, you will accrue additional service credit, which would increase your benefit. However, if you were to leave public service at 55, your benefit would not increase if you waited until 62 to apply for retirement.

Our online retirement benefit calculator allows most members to estimate their benefit with different retirement dates, final average salaries and service credit totals. By changing each variable, you can see the impact it may have on your benefit.

- gloria riveraMarch 25, 2024 at 6:37 am can I retire with 22 years of service at age 62 in a tier 4 and still get my full retirement.

- NYSLRS Post author March 25, 2024 at 1:26 pm There is generally no benefit reduction for Tier 4 members beginning at age 62. You may be interested in reading our blog post, Member Milestones for ERS Tier 3 and 4. You can use Retirement Online to create a pension estimate based on the salary and service information we have on file for you. Sign in to Retirement Online. From your Account Homepage, go to the ‘My Account Summary’ section and click the “Estimate my Pension Benefit” button.

You can:

• Enter different retirement dates and beneficiaries to see how they affect your potential benefit;

• Adjust your earnings or service credit if you anticipate an increase in earnings or plan to purchase past service; and

Save or print your estimate.

- NYSLRSApril 30, 2018 at 2:12 pm Pension benefits are paid on a monthly basis, at the end of every month. For example, we send out May’s payment at the end of May. If your benefit is paid by direct deposit, you will have access to it on the last business day of each month. If your benefit is paid by check, we will mail it on the second-to-last business day of each month. For specific pension payment dates, check out our Pension Payment Calendar page.

- NYSLRSJuly 12, 2017 at 12:21 pm If you’re an ERS member, starting in 2008 would place you Tier 4. Tier 4 members only need five full-time years of service credit to earn a retirement benefit. However, there is also an age requirement: You must be at least 55 years old to qualify for a retirement benefit. And, to receive your full benefit, you must be 62 years old at retirement. If you retire before 62 with less than 30 years of service, you will receive a reduced benefit. For account-specific information, we recommend emailing our customer service representatives using our secure email form (see link below). One of our representatives will review your account to address your questions. Filling out the secure form allows us to safely contact you about your personal account information. Please allow five to seven business days for a response. http://www.emailNYSLRS.com

- NYSLRSMay 24, 2017 at 1:12 pm Actually, a recent blog post tackles filing for retirement. If you are a Tier 3, 4, 5, or ERS Tier 6 member, you are eligible for a benefit on your 55th birthday. You can submit your retirement application 15 to 90 days before you turn 55. If you are off payroll and you submit your application on or after your 55th birthday, your application will be effective immediately upon filing with this office. Assuming you’re a Tier 3 or 4 ERS member, your lump-sum vacation payout will still count towards your final average salary (FAS), even if you go off state payroll, as long as your FAS is based on your last three years of service. Learn more in the ERS Tier 3 and 4 retirement plan book. For more detailed, account-specific information, please email our customer service representatives using our secure email form. One of our representatives will review your account to address your questions. Filling out the secure form allows us to safely contact you about your personal account information. Please allow five to seven business days for a response.

- ErinJune 11, 2021 at 8:15 pm In the above reply, you say the “yiur FAS is based on last three years of service” isn’t it your highest three years? At any point you’ve been in the system? As mentioned in a few posts above?

- NYSLRS Post author June 14, 2021 at 12:47 pm Yes, Final Average Salary (FAS) is the average of the highest three (five for Tier 6) consecutive years of earnings. Usually your FAS is based on the years right before retirement, but they can come anytime in your career.

- NYSLRSApril 5, 2017 at 1:05 pm In this case, if a member has less than 20 years of service, the formula is:

FAS x 1.66% x total years of service. If a member has 20 to 30 years of service, the formula is:

FAS x 2% x total years of service. If a member has 30 or more years of service, the formula is:

FAS x 2% x 30 PLUS FAS x 1.5% X each year beyond 30 years.

- R.TMay 3, 2018 at 10:40 am Hello. It the last sentence accurate? The Comptroller’s website says: •For each year of credited service beyond 30 years, you will receive 1.5 percent of your FAS. Example shown:

35,000 × 2% × 30 years = $21,000 per year

plus

$35,000 × 1.5% × 1 year = $525 per year

= $21,525 per year or

$1,794 per month

- NYSLRS Post author May 4, 2018 at 8:21 am ERS Tier 3 and 4 members who have reached 30 years of service receive 1.5 percent of their final average salary (FAS) for each additional year of service. So a member with 31 years would receive a retirement benefit equal to 61.5 percent of their FAS.

- JJTMay 14, 2018 at 2:40 pm Hello, I had same question as previous commenter RT did when reading your April 5, 2017 comment: That comment says: “If a member has 30 or more years of service, the formula is:

FAS x 2% x total years of service PLUS FAS x 1.5% X each year beyond 30 years.” But what I believe it should say is: “If a member has 30 or more years of service, the formula is:

FAS x 2% x 30 YEARS of service PLUS FAS x 1.5% X each year beyond 30 years.” Your follow up comment on May 4th saying that someone with 31 years of service would have 61.5 percent of FAS does appear to be the correct info, but that is different than than the first info I quoted above.

- NYSLRS Post author February 10, 2020 at 3:07 pm Limits to final average salary (FAS) are based on retirement plan and tier. You can find information about how your FAS is calculated on our website. Most Tier 1-4 members can use our Benefit Projector Calculator to estimate their retirement benefit. The calculator allows you to enter different retirement dates and FAS to compare potential benefits.

- NYSLRSApril 5, 2017 at 1:10 pm Benefits and reductions vary significantly by tier and plan. We have two ways to help you compare your specific pension benefits at age 55 versus 58 or 60:

- Our online retirement benefit calculator allows most members to estimate their benefit with different retirement dates, salary and service credit totals. By changing each variable, you’ll be able to see the impact it may have on your benefit.

- If you are over 50 years old, you can email us using our secure contact form (http://www.emailNYSLRS.com) to request benefit projections based on your salary and service reported to date. Benefit projections can also be requested through our automated phone line by calling 1-866-805-0990. To hear the member menu, press 3, then 1 for the Employees’ Retirement System or 2 for the Police and Fire Retirement System, and then press 4 for the benefit projector.

- NYSLRSMarch 6, 2017 at 2:40 pm If you leave public service, you may apply for a retirement benefit at age 55. However, certain benefits could be affected if you don’t retire directly from the public payroll. Unfortunately, the NYSLRS Social Media team doesn’t have access to members’ account information. To get the account-specific information you need, please email our customer service representatives using our secure email form (http://www.emailNYSLRS.com). One of our representatives will review your account and get back to you. Filling out the secure form allows us to safely contact you about your personal account information. Please allow five to seven business days for a response. In addition, you may want to speak with New York State Civil Service or your employer’s health insurance benefit administrator for information about your health insurance benefits. (Please note: NYSLRS does not administer health insurance benefits for its members or retirees). If you participate in the New York State Deferred Compensation plan, you may also wish to speak with one of their representatives.

- MartaMay 12, 2020 at 7:42 pm very, very true!!